With the profound economic and social disruptions caused by COVID-19 worldwide, it is understandable for Playtech to carry out some sort of reform to navigate the crisis. However, its potential disposal of Finalto to a four-firm consortium, in our opinion, doesn’t seem like a change for the better in these challenging and uncertain times.

First, let’s begin with some background information

Playtech is a market leader in the gaming and financial trading industries. It diversifies its operations into three main segments: i) Core B2B gaming, where technology is provided on a B2B basis to online and retail gaming operators; ii) Core B2C gaming, where technology is deployed directly as a B2C operator in select markets; and iii) Finalto, a financial division that offers trading and liquidity solutions to brokers and end customers.

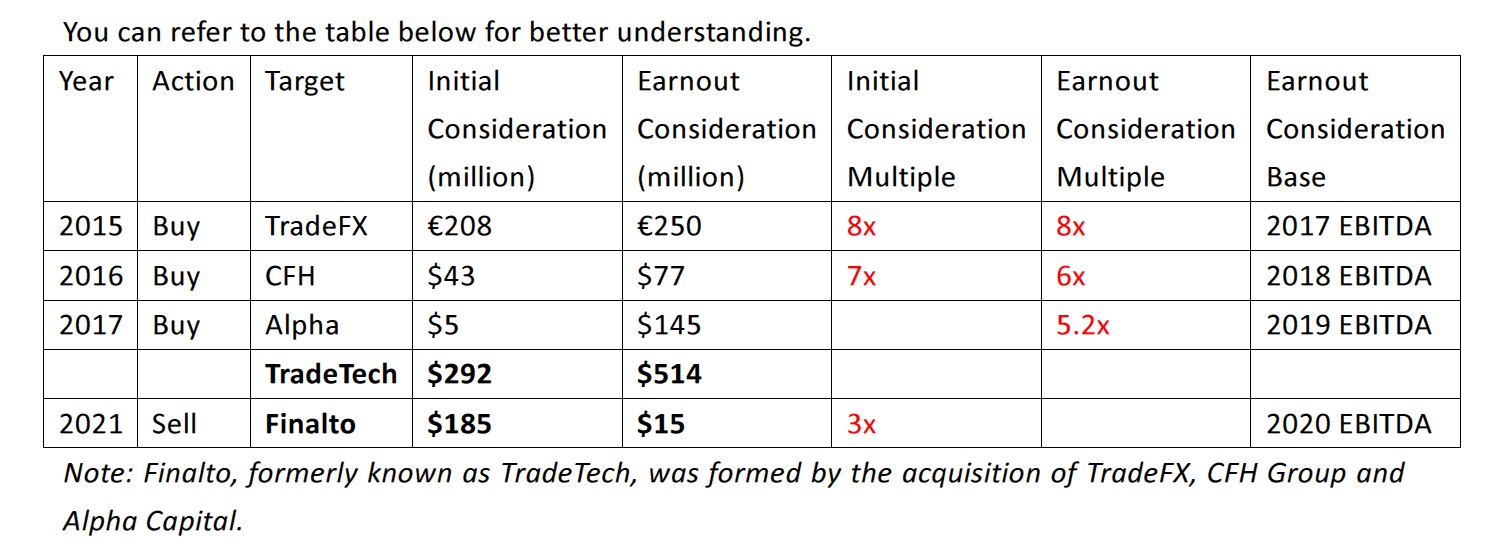

Finalto, formerly known as TradeTech, was formed by Playtech with the acquisition of three B2B and B2C Forex market entities between 2015-2017 in an effort to ‘give the Group (Playtech) access to the positive growth trends in this dynamic sector and help to diversify the Group’s earnings by product, geography and customer base and improve its quality of earnings’.

Yet the divestment of the financial division has been brought into discussion since 2019 after Playtech shifted its strategic focus to simplifying its operations and disposing non-core assets.

In January 2021, Playtech confirmed that it is in exclusive discussions with a management consortium backed by four Israeli investment businesses for the sale of Finalto with a cash offer of up to $200 million. The Board of the company added that the sale is likely to complete by the end of 2021. An impairment charge of €221.3 million was recognised for the financial division as a result.

Now, let’s look at the reasons why it sounds like a bad deal

1. An important profit engine with abundant cash

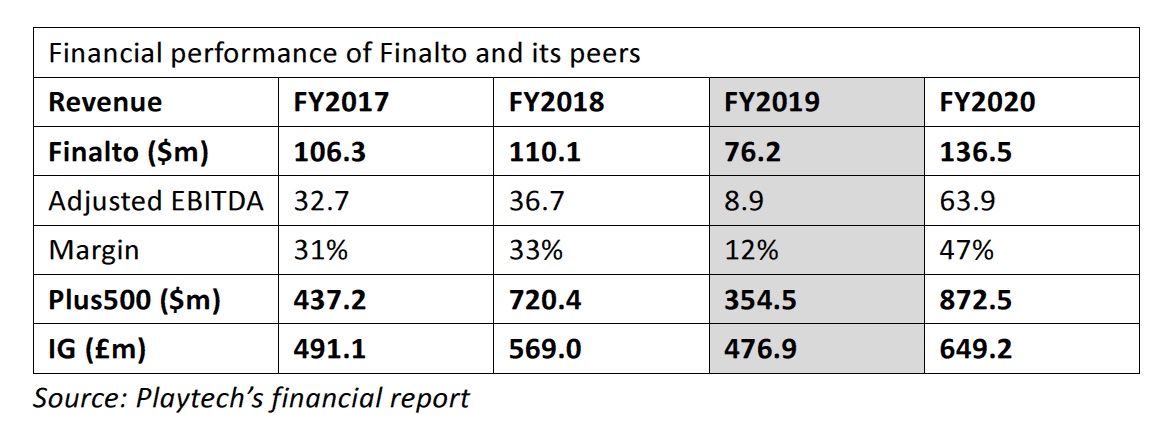

According to Playtech’s financial reports, Finalto has fared pretty well since 2017. The only exception was 2019, when the financial division reported weak performance – like its many other peers – because the European Securities and Markets Authority (ESMA) tightened rules on the provision of contracts for differences (CFDs) and binary options the year before.

Putting 2019 aside, Finalto has been one of the most consistent and profitable units of Playtech. In 2020, its revenue soared 80% and adjusted EBITDA skyrocketed 623% year on year while the two core gaming segments reported significant decline in adjusted EBITDA due to ‘retail closures and the cancellation or postponement of sporting events as a result of the COVID-19 pandemic’.

If you look at the overall adjusted EBITDA, the year-on-year decline actually increases from 19% to 32% when Finalto is excluded. In other words, the resilient financial performance of Playtech in 2020 was mainly driven by Finalto.

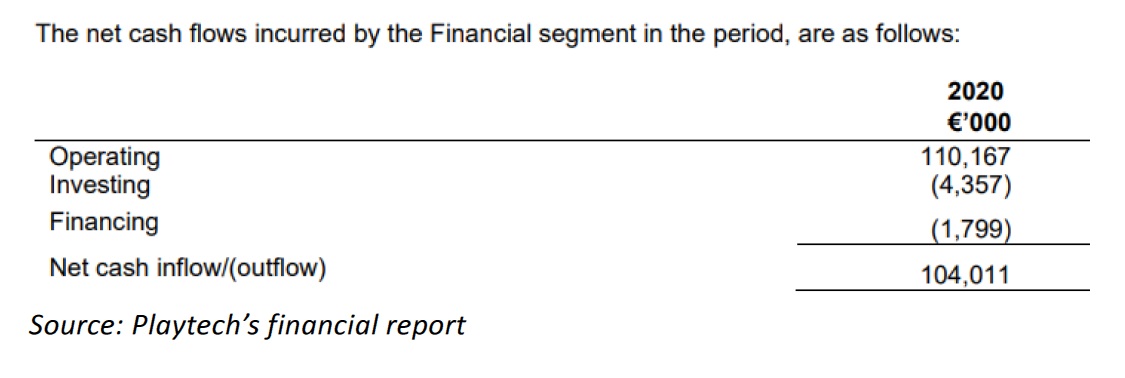

In addition to superior profitability, Finalto also has great cash generating ability. With its operating and net cash inflow almost equal to its revenue, the financial division would certainly be able to bring steady and abundant cash flow to Playtech in years to come.

By the end of 2020, Finalto had cash of €416 million, accounting for 55.3% of Playtech’s total cash of €752 million (excluding revolving credit facility).

2. Hence, Playtech is selling it way too cheap

Given Finalto’s strong profitability, steady growth and abundant cash, we are quite shocked that Playtech would even consider about selling it for merely $200 million. Judging from Finalto’s EBITA, it’s definitely worth more than that and deserves a high valuation multiple.

3. Outlook remains uncertain amid a pandemic with no end in sight

Playtech itself said that its core gaming businesses were ‘severely impacted’ by COVID-19 through government lockdown restrictions, the cancellation of sporting events worldwide and the closure of retail shops in 2020. Then I see no reason why the company would want to dispose its major profit contributor in a difficult time like this. The end of the pandemic is not yet in sight with new COVID-19 variants currently raging in various countries. It is possible for Playtech’s gaming businesses to take another severe hit any time soon.

Since Playtech is already in a heavily regulated industry, where any regulatory change could greatly affect its operations and profitability, it is essential for the gaming software leader to maintain business stability and diversification to mitigate risk, at least for now.

Sadly, a significant yet unrecognised unit

All in all, Finalto has brought immense benefits and value to Playtech. It’s a pity that the gaming software leader doesn’t consider it an asset of particular importance.

It is worth noting that its approach to the valuation of Finalto seems lacking due consideration and unconvincing. Underselling such a profitable unit just to ‘simplify its operations’ doesn’t make sense. It’d be better for the company to improve its transparency and give a proper account of how it came up with that decision.

Source:

https://data.fca.org.uk/artefacts/NSM/data-migration/LSE20150402070013_012304001.html

https://data.fca.org.uk/artefacts/NSM/data-migration/LSE20161114070012_013033419.html

https://data.fca.org.uk/artefacts/NSM/data-migration/LSE20170823070004_13338670.html

Page 92 NOTE 24C – ASSETS HELD FOR SALE – http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2020/fy20-rns-v16.pdf

Page 1 http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2020/fy20-rns-v16.pdf

NOTE 8 – DISCONTINUED OPERATION

Finalto 17-18: http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2018/full-year-results-presentation-21-02-2019.pdf

Page 25

Finalto 19-20: http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2020/fy2020-results-presentation.pdf Page 12

Plus 500:

https://cdn.plus500.com/media/Investors/Reports/Plus500_Annual_Report_20.pdf?_ga=2.150803761.681538146.1617192854-1421769125.1609245081

Page 22

IG: https://www.iggroup.com/investors/financial-results

http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2020/fy20-rns-v16.pdf

Page 93, NOTE 24 – ASSETS HELD FOR SALE

http://playtech-ir.production.investis.com/~/media/Files/P/Playtech-IR/results-reports-webcasts/2020/fy2020-results-presentation.pdf

Media Contact

Company Name: Global Market Analyst

Contact Person: Roberto W. Ong

Email: Send Email

Phone: 0800-041-8813

Country: United Kingdom

Website: www.globalanalyst.space