NEW YORK, NY / ACCESSWIRE / April 30, 2022 / The U.S. Small Business Administration (SBA) laid down a final ultimatum on the Economic Injury Disaster Loan (EIDL) program. On Thursday the SBA announced more urgent deadline news. Small businesses have until the end of day on Friday May 6th as the last day the SBA will accept COVID-19 related EIDL loan increase requests or reconsideration requests for loans. These EIDL loan modifications, increase requests, and denial reconsiderations will continue to be processed in the order received until all pandemic funds are exhausted. Business owners should seek expert assistance as soon as possible to file before the deadline.

SBA announces the final last chance filing date of May 6th for COVID-19 Economic Injury Disaster Loans (EDILs). Image Credit: 123rf / Alfexe.

“The SBA urgent deadline is really the last chance to file and have the best shot at obtaining low-interest loan funds from the SBA’s Economic Injury Disaster Loan (EIDL) Program. Our Team of Advisors will be working around the clock this next week to help business owners who need paid professional help to get their filings in by the May 6th deadline,” said Marty Stewart, Chief Strategy Officer of Disaster Loan Advisors (DLA).

Since the pandemic started, Disaster Loan Advisors have been at the EIDL forefront developing and refining exclusive expertise in both SBA increase requests and recon requests. By strategically assisting business clients with expedited SBA EIDL loan filings, such as reconsideration requests and appeals, DLA has helped businesses obtain a minimum of $100,000 or more through reconsideration appeals, and up to $500,000 to $2,000,000 through the loan increase modification process.

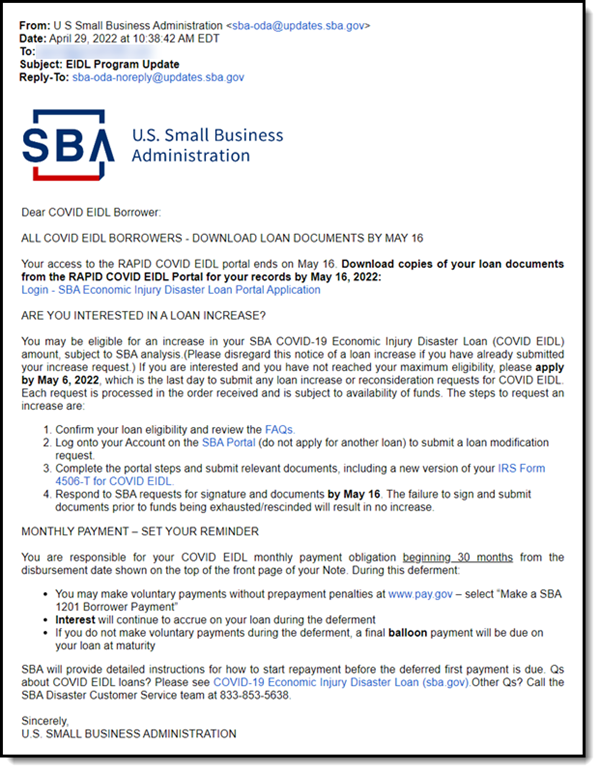

The New U.S. Small Business Administration (SBA) Email Announcing the Official Deadline Filing of May 6th for COVID-19 EIDL Funds

In early April, there was another SBA EIDL loan email urging small business owners about a last chance for an increase or reconsideration due to funds running low.

Many business owners received this email from the SBA on Thursday April 28th.

Subject: EIDL Program Update

Dear COVID EIDL Borrower:

ALL COVID EIDL BORROWERS – DOWNLOAD LOAN DOCUMENTS BY MAY 16

Your access to the RAPID COVID EIDL portal ends on May 16. Download copies of your loan documents from the RAPID COVID EIDL Portal for your records by May 16, 2022:

Login – SBA Economic Injury Disaster Loan Portal Application

Are You Interested in a Loan Increase?

You may be eligible for an increase in your SBA COVID-19 Economic Injury Disaster Loan (COVID EIDL) amount, subject to SBA analysis.(Please disregard this notice of a loan increase if you have already submitted your increase request.) If you are interested and you have not reached your maximum eligibility, please apply by May 6, 2022, which is the last day to submit any loan increase or reconsideration requests for COVID EIDL. Each request is processed in the order received and is subject to availability of funds.

The Steps to Request a Loan Increase Are:

- Confirm your loan eligibility and review the FAQs.

- Log onto your Account on the SBA Portal (do not apply for another loan) to submit a loan modification request.

- Complete the portal steps and submit relevant documents, including a new version of your IRS Form 4506-T for COVID EIDL.

- Respond to SBA requests for signature and documents by May 16. The failure to sign and submit documents prior to funds being exhausted/rescinded will result in no increase.

Monthly Payment – Set Your Reminder

You are responsible for your COVID EIDL monthly payment obligation beginning 30 months from the disbursement date shown on the top of the front page of your Note.

During this deferment:

- You may make voluntary payments without prepayment penalties at www.pay.gov – select “Make a SBA 1201 Borrower Payment”

- Interest will continue to accrue on your loan during the deferment

- If you do not make voluntary payments during the deferment, a final balloon payment will be due on your loan at maturity

- SBA will provide detailed instructions for how to start repayment before the deferred first payment is due.

Questions about COVID EIDL loans? Please see COVID-19 Economic Injury Disaster Loan (sba.gov).Other Questions? Call the SBA Disaster Customer Service team at 833-853-5638.

Sincerely,

U.S. SMALL BUSINESS ADMINISTRATION

The SBA email stating COVID-19 related EIDL filing deadline. Image Credit: SBA.gov.

Critical Next Step for Business Owners to Receive COVID-19 EIDL Funds

“This truly is the last chance for companies to receive pandemic related SBA EIDL funds. By doing an increase filing, or a reconsideration appeal to overcome being denied previously. In either case, speed is needed. Business owners should seek expert help immediately to file by the SBA May 6th deadline,” said Stewart.

About Disaster Loan Advisors™

Disaster Loan Advisors™ is a trusted team of SBA EIDL loan consulting professionals dedicated to saving small businesses and companies from lost sales, lost customers, lost revenue to assist in rescuing your business from potential financial ruin from the COVID-19 / Coronavirus disaster, Delta and Omicron variants, and other declared natural disasters.

DLA specializes in assisting ownership groups with multiple business entities, multiple location restaurants and retail groups, and other complex situations that require an expert to be brought in to assess the situation and create the most strategic path forward.

DLA further specializes in another key pandemic-era SBA / IRS program where business owners are leaving a lot of relief fund money on the table. It is the often misunderstood and confusing Employee Retention Tax Credit (ERTC) program. Business owners can retroactively receive up to $33,000 back for each W-2 employee they had on payroll for the 2020 and 2021 tax filing years. Done correctly, these tax credits or cash refunds can be claimed retroactively for up to 3 years. 4/15/24 is the deadline for the 2020 tax year and 4/15/25 is the deadline for the 2021 tax year. It’s encouraged that companies obtain professional assistance in going through the complex 941-X amended filing process to help your company maximize the full value of the ERTC program.

Has Your Small Business or Company Suffered Financial Loss due to COVID-19, Hurricane Ida, or Other Natural Disaster? Was Your SBA Loan Application Denied for an EIDL Loan? Are You Looking for an Increase to Your Existing SBA EIDL Loan (up to $2 Million)? Need Strategic Guidance Before You Make Your Next Move with the SBA?

CONTACT:

Disaster Loan Advisors

Elena Goldstein

Director of Media Relations

877-463-9777 ext. 3

elena.goldstein@disasterloanadvisors.com

Connect with Disaster Loan Advisors via social media:

Linkedin, Facebook, Instagram, Twitter, and CrunchBase.

For a strategic exploratory conversation, schedule a free consultation call by visiting:

https://www.disasterloanadvisors.com/contact

SOURCE: Disaster Loan Advisors

View source version on accesswire.com:

https://www.accesswire.com/699605/EIDL-Economic-Injury-Disaster-Loans-SBA-COVID-Deadline-May-6th